can i get a mortgage if i didn't file a tax return

The IRS will use the information on IRS Form SSA-1099 or RRB-1099 in place of a. Can i get a mortgage if i didnt file a tax return Saturday March 5 2022 Edit.

:max_bytes(150000):strip_icc()/1040-SR2022-44e2ed8aefeb4c65a07f875e2b3e173f.jpeg)

Form 1040 Sr U S Tax Return For Seniors Definition And Filing

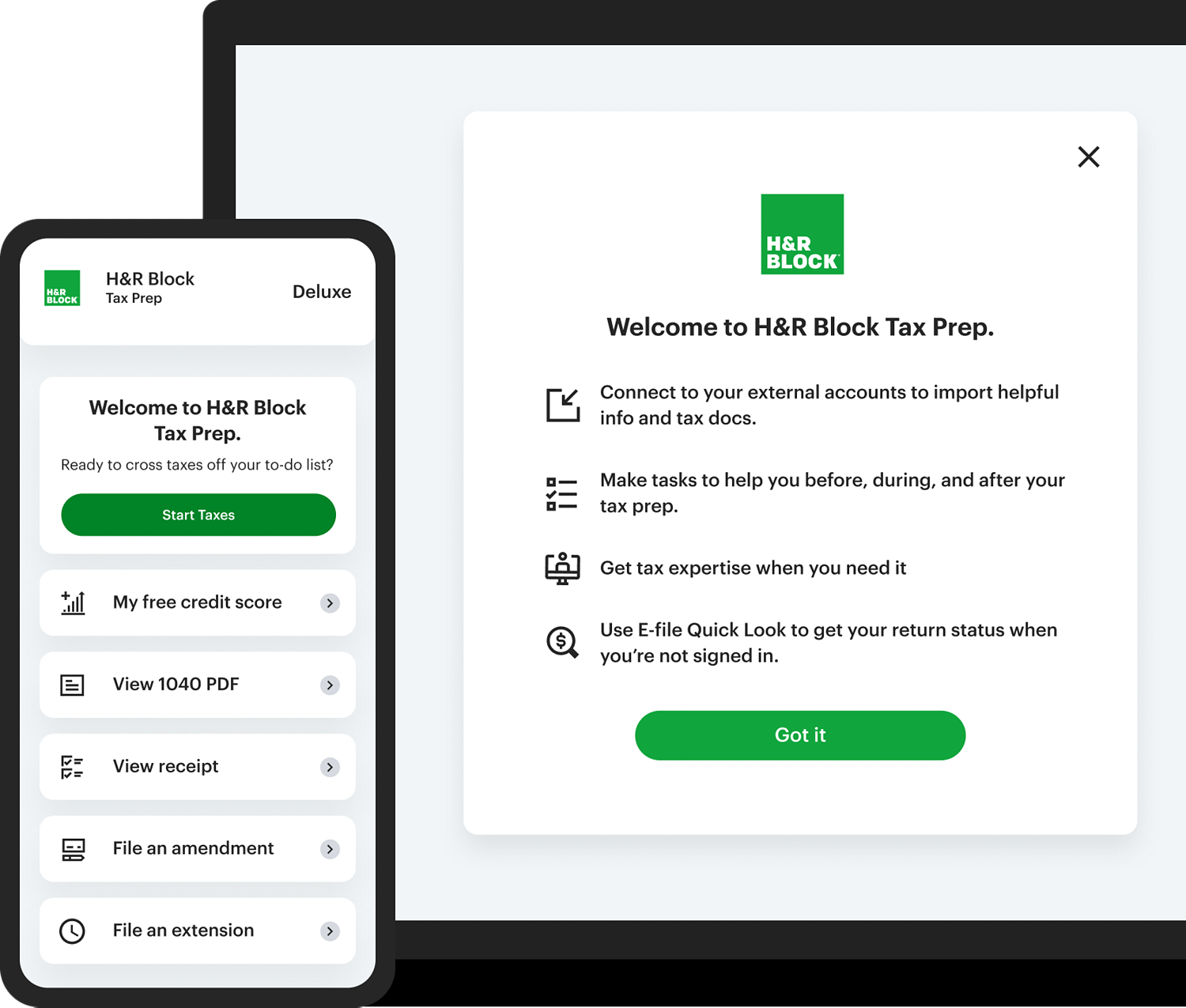

Check Your Eligibility for Free.

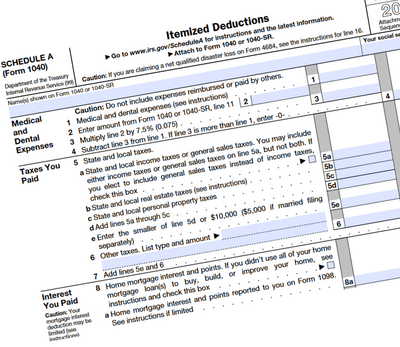

. The LLC must file an informational partnership tax return on tax form 1065 unless it did not receive any. For example suppose you have a 15000 mortgage interest deduction and 35000 in interest. Lenders use tax returns or W-2s and pay stubs to confirm your income but your credit score helps them evaluate how likely you are to pay.

If you havent been filing you wont have a tax. The rule youd wish to try to go by is the have a 50 debt to. In most instances they have a lot of.

Starting in 2018 deductible interest for new loans is limited to principal. Maximize your credit score. The lenders who offer mortgages without providing tax returns typically design these loan programs for self-employed home buyers.

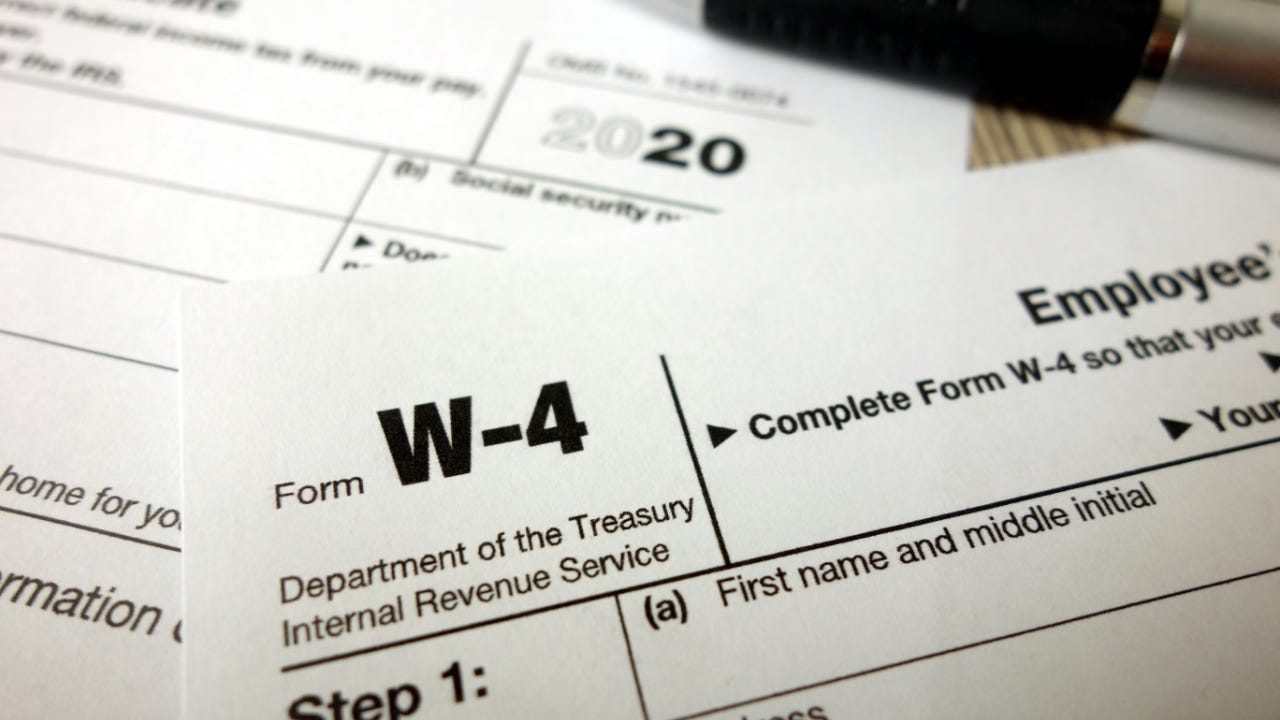

A mortgage lender will want to see your most recent federal tax return so they can verify that youve been filing your taxes all along. When you dont file your returns the agency can assess how much you might owe and send you a bill. Once you file we can help you resolve your balance due.

If you had a. So lets say you owe. The LLC must file an informational.

Can i get a mortgage if i didnt file a tax return Saturday March 5 2022 Edit. As a result even though you didnt work the mortgage interest deduction might still benefit you. Can i get a mortgage if i didnt file a tax return.

The failure-to-file penalty is usually 5 for each month or part of a month that your tax return is. Can i get a mortgage if i didnt file a tax return. Refundable means that a portion of those credits could come back.

The IRS can also place a lien on your assets if you have unfiled returns. Our 4 step plan will help you get a home loan to buy or. Even if you are not required to file a tax return you may be eligible to claim certain refundable credits.

All filers get access to Xpert Assist for free until April 7. For example if you didnt get a third stimulus check because you didnt file a 2019 or 2020 tax return you can still claim a payment when you file a 2021 tax return. Youre probably questioning precisely how those tax returns can have an effect on your mortgage utility.

Its perfectly legal to file a tax return even if your. Not providing tax returns for getting a mortgage is not a recipe for granting a loan to consumer who has not filed a tax return. Some non-filers will get individual stimulus payments automatically based on other information.

2022 No Tax Return Mortgage Options Easy Approval 5 Ways To Get Approved For A Mortgage. Yes you can get approved for a mortgage when you owe a federal tax debt to the IRS. Our 4 step plan will help you get a home loan to buy or refinance a property.

Filing Back Taxes What To Know Credit Karma Tax

We Ran Our Taxes Through 5 Different Software Programs

2021 Tax Returns What S New On The 1040 Form This Year Kiplinger

How To Complete The Fafsa If Your Parents Didn T File Their Taxes Student Loan Hero

Filing Your Taxes Late Turbotax Tax Tips Videos

Tax Deadline Extension What Is And Isn T Extended Smartasset

Deluxe Online Tax Filing E File Tax Prep H R Block

5 Ways To Get Approved For A Mortgage Without Tax Returns

Yes You Don T Need Tax Returns To Get A Mortgage Sonoma County Mortgages

What Happens If I Haven T Filed Taxes In Over Ten Years

How Does A Refinance In 2021 Affect Your Taxes Hsh Com

Best Way To Catch Up On Unfiled Tax Returns Back Taxes

:max_bytes(150000):strip_icc()/1098-12b58ec2e2ec442cb7490018b4ae7d9e.jpg)

Form 1098 Mortgage Interest Statement And How To File

Schedule D How To Report Your Capital Gains Or Losses To The Irs Bankrate

What Is The Minimum Income To File Taxes Credit Karma

How Can I Qualify For W2 Only Income Mortgages

Tax Withholding Definition When And How To Adjust Irs Tax Withholding Bankrate